Spotlights

Claims Adjuster, Claims Analyst, Claims Examiner, Claims Representative, Claims Specialist, Corporate Claims Examiner, Field Claims Adjuster, General Adjuster, Home Office Claims Specialist, Litigation Claims Representative

Insurance is one of those things we hate paying for…until we need it!

Insurance policies help cover costs when we’re going through tough situations, such as a car accident, property damage, theft, or a death in the family. In such events, we can usually file a claim if we have the right insurance coverage.

But insurance companies don’t just pay claims without looking into them first. They assign a Claims Adjuster to work closely with the insurance policyholder to assess the claim and determine the appropriate payout, as needed.

Claims Adjusters typically work for or are contracted by the insurance provider. So, even though they are working to assist claimants, they must also look out for the best interests of their employers. That’s why part of their job is to investigate potentially fraudulent claims. Their work is pivotal in helping individuals and businesses recover from unexpected losses while ensuring fairness to the insurance companies, as well.

- Ensuring fair, efficient claim resolutions

- Helping individuals and businesses recover from loss

- Constant variety getting to work on different claims

Working Schedule

- Claims Adjusters work standard 40-hour weeks but may have to work overtime during natural disasters or high-claim periods. The role may include both office and fieldwork, requiring travel to inspect damages firsthand.

Typical Duties

- Review claimants’ claims and policies to determine coverage terms and amounts

- Verify ownership of damaged or stolen property. Verify claimant employment records, when applicable

- Guide policyholders through the claims process

- Interview claimants and witnesses. Consult police and hospital records, as needed

- Inspect property damage or personal injury claims to determine the insurance company’s liability

- Work with contractors, repairers, and medical professionals to gather information on the extent of damages and cost estimates for repairs or treatments

- Correct any claim form errors or omissions

- Analyze findings and document investigative processes. Report findings and recommendations to the insurance company

- Negotiate settlements with claimants while representing the insurance company

- Issue or authorize payments to claimants, as applicable

- Maintain records of claims in computer systems. Report claim statuses to company management

- Collaborate with attorneys on claims requiring litigation or legal expertise. Gather and document evidence to support contested claims

- Represent insurance companies during trials or mediation

- Review legal billing to ensure cost-effective claims handling

Additional Responsibilities

- Look for signs of insurance fraud via investigations and fraud detection techniques

- Refer claims requiring further investigation to special investigators or adjusters

- Identify and report financial discrepancies (such as overpayments or underpayments)

- Recommend adjustments to the company’s claims reserve (i.e., the funds set aside to pay future claims)

- Participate in committee meetings

- Stay informed about new insurance policies, legislation, and technologies

- Network with insurance professionals, attorneys, and industry partners

Soft Skills

- Analytical thinking

- Active listening

- Clear communication

- Compliance-orientation

- Conflict resolution

- Critical thinking

- Customer service

- Decision-making

- Detail-oriented

- Integrity

- Monitoring

- Negotiation

- Problem-solving

- Public relations

- Teamwork

- Time management

Technical Skills

- Proficiency in interpreting insurance policies and coverage

- Understanding the principles of insurance claims handling and settlement

- Extensive knowledge of construction, automotive repair, or other relevant technical fields to assess damages accurately

- Familiarity with legal, medical, and repair cost terminology

- Use of claims management software and databases

- Knowledge of fraud detection techniques and practices

- Automotive repair shops and construction companies

- Government insurance services

- Independent claims adjusting firms

- Insurance companies

- Legal firms specializing in insurance claims

When someone files an insurance claim, it’s usually because something bad, maybe even tragic, has happened in their lives. Claims Adjusters must be ready to handle emotionally charged situations with empathy and professionalism.

At the same time, they have to be objective and analytical when it comes to reviewing the claim and adhering to the insurance policy’s terms. Some claims may not pay out as the claimant would like. Certain cases may even have to be litigated to resolve them. Meanwhile, as many as 20% of claims could be considered fraudulent and must be investigated.

Claims Adjusters must be subject matter experts who are familiar with a wide range of claims-related topics, such as property damage estimates, average automotive repair costs, typical medical billing amounts, etc. They must also stay up-to-date with evolving insurance laws, policies, and technology.

Their workload can spike considerably after a large-scale accident or natural disaster. This can add significant pressure to work fast and accurately to resolve claims while claimants wait, often impatiently, to receive a payout for the losses they’ve suffered.

New technologies are helping to streamline the claims process, making it faster and more efficient. That’s good news for Claims Adjusters, except for one thing—the increased efficiency is impacting job growth in this profession. Per the Bureau of Labor Statistics, overall employment in this field is projected to go down by 3% in the coming decade.

That said, environmental changes seem to be increasing the frequency of natural disasters which can lead to property damage and, in turn, insurance claims. Insurance companies obviously can’t afford to pay out more in claims than they earn from policy premiums (the amount paid to them every month to keep an insurance policy active). That’s why they operate using risk assessments that rely on predictions based on probability!

For example, the odds of Earth being hit by a big asteroid in any given year are about 1 in 500,000. Based on those odds, the probability of sustaining asteroid-related damage seems fairly low. An insurance company might reasonably predict that no large asteroids will hit this year, and thus be willing to provide coverage.

But when things become unpredictable or the odds of an event occurring become more probable, companies may be hesitant to offer coverage. In fact, Renewing America notes that a “2021 survey of insurance risk managers found that 60 percent feared climate change would make certain geographic areas uninsurable.” Because of these issues, insurers are using predictive analytics to anticipate future claims trends based on environmental changes.

Individuals drawn to a career as a Claims Adjuster might have enjoyed problem-solving activities or helping others in difficult situations. They may have also been intrigued by investigation processes and had a knack for detail-oriented tasks!

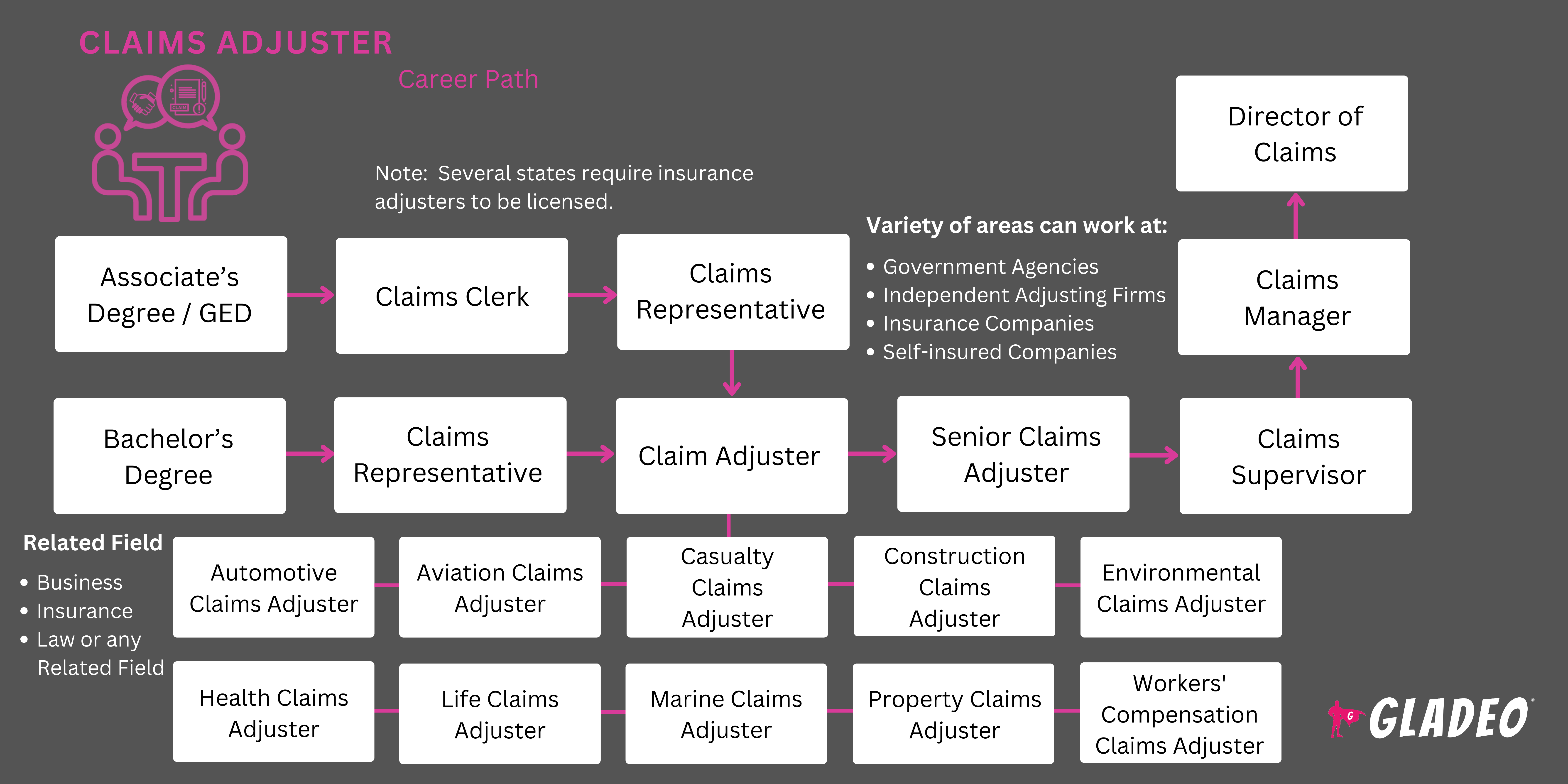

- Being a Claims Adjuster requires a mix of education, related work experience, and certification

- Some positions require a bachelor’s degree with a major in risk management and insurance, business administration, finance, or a related area, but many entry-level roles accept candidates with a high school diploma or equivalent plus sufficient relevant insurance work experience

- Per O*Net, about 56% of Claims Adjusters hold a bachelor’s

- Common college course topics may include:

- Business Law

- Ethics in Insurance

- Financial Accounting

- Principles of Insurance

- Property and Casualty Insurance

- Risk Management

- Certification options include:

- AACE International, Inc. - Certified Forensic Claims Consultant

- Association of Certified Fraud Examiners credential

- Insurance Data Management Association - Associate Insurance Data Manager

- Insurance Regulatory Examiners Society - Accredited Insurance Examiner

- International Association of Special Investigation Units - Certified Insurance Fraud Investigator

- International Claim Association - Associate, Life and Health Claims

- Society of Financial Examiners - Automated Examination Specialists

- The Institutes -

* Associate in National Flood Insurance

* Associate in Regulation and Compliance

* Certified Claims Professional

- Most insurance companies will provide a certain amount of On-the-Job training, with some employers willing to provide much more than others!

- Some states require adjusters to have a license, but other states allow them to work under the license of their employing company

- A license may require 40 hours of prelicensing training, though some states only require that candidates receive a passing score on a licensing exam

- The National Insurance Producer Registry provides information about state licensure requirements

- Candidates interested in pursuing a career in claims adjustment should look for universities that offer strong programs in business, business administration, finance, risk management, or insurance

- Look for programs offering hands-on experience or opportunities for internships with insurance companies

- Consider the cost of tuition, discounts, and local scholarship opportunities (in addition to federal aid via the FAFSA)

- In high school, study hard in math, business, and economics courses

- Develop your writing and verbal communication skills

- Seek internships or part-time jobs in insurance companies to gain relevant experience

- Join business or finance clubs to learn more about the industry

- Go to seminars and workshops on insurance, claims processing, and customer service

- Pursue a relevant college major like risk management and insurance or business administration

- Look for insurance-related scholarship opportunities, like the one offered by the Association of Insurance Compliance Professionals

- Try to determine which type of insurance you want to focus on, so you can learn more about associated topics

- For example, if you want to work with medical claims, it could help to learn about medical billing, coding, and typical costs

- If you work with auto claims, you could learn about auto repair shops and typical costs for repair work

- Legal courses may be handy if you’ll work on liability or worker's compensation claims

- Determine your state’s licensing requirements, if any. Take a preparatory course or purchase self-study materials so you’ll do well on the exam!

- Join professional organizations like the International Claim Association or The Institutes to network and engage in professional development

- Obtain applicable certifications through organizations such as the AACE International, Insurance Data Management Association, International Claim Association, or The Institutes

- Keep in mind that some states require a license. However, employers are often willing to hire adjusters who haven’t gotten their license yet, and may help them prepare for their exams!

- Scan job postings on portals like Indeed and Glassdoor, as well as Craigslist for smaller local jobs

- Ask your school’s career counselor or service center for help finding internships and job fairs, and for preparing resumes and conducting mock interviews

- Network with professionals in the insurance industry whenever possible. Many jobs are still found through word of mouth

- Prepare your resume to highlight all relevant experiences, education, and skills

- Check out examples of Claims Adjuster resumes for ideas. Incorporate keywords like:

- Claims Investigation

- Claims Processing Software

- Customer Service

- Damage Assessment

- Documentation and Reporting

- Fraud Detection

- Policy Analysis

- Regulatory Compliance

- Risk Management

- Settlement Negotiation

- Highlight your ability to analyze information, solve problems, and communicate effectively

- Practice for interviews by reviewing common Claims Adjuster interview questions such as “How do you effectively determine insurance coverage?”

- Prepare for interviews by researching the hiring organization’s website to learn about their mission and typical clients

- If given the names of the persons who will interview you, look up their professional biographies to learn a little about them

- Stay informed about current industry trends, developments, and new terminologies

- It takes at least a couple of years of demonstrated high-quality work performance to move up the ranks

- For each promotion or advancement received, expect at least two more years of solid work as well as additional education and training to reach the next level

- Speak with your supervisor about career progression. Inquire about which areas you could study further to best serve the company. Let your employer know you’re willing to undergo additional training courses to enhance your skills

- Pursue additional certifications in high-demand areas or hard-to-fill niches, if your company needs. Ask your employer if they would be willing to cover tuition or exam costs

- Ask to handle more complex claims or manage projects requiring leadership skills

- If necessary to advance, consider applying to another company if you see a job opening

- Be proactive within professional organizations such as the American Planning Association. Grow your reputation and standing within the industry by presenting speeches or publishing thought leadership pieces

- Consider earning a graduate degree in business. It could qualify you for management positions

- Seek a mentor for guidance and professional development

- Stay informed about industry trends and innovations by reading industry news and participating in discussion groups

Websites

- AACE International, Inc.

- American Property Casualty Insurance Association

- Association of Certified Fraud Examiners

- Claims and Litigation Management Alliance

- Insurance Data Management Association

- Insurance Regulatory Examiners Society

- International Association of Special Investigation Units

- International Claim Association

- Loss Executives Association

- National Association of Independent Insurance Adjusters

- National Association of Insurance Commissioners

- National Association of Public Insurance Adjusters

- National Insurance Crime Bureau

- National Insurance Producer Registry

- National Society of Professional Insurance Investigators

- Society of Chartered Property and Casualty Underwriters

- Society of Claim Law Associates

- Society of Financial Examiners

- Society of Registered Professional Adjusters

- The Institutes

- Workers’ Compensation Claims Professionals

Books

- Adjusting to a Career in Property & Casualty Claims, by Chris Casaleggio

- The Appraisal Process: Resolution of Disputed Insurance Claims, by John A. Voelpel, III

- The New Insurance Claim Adjuster Study Guide 2024-2025 Most Comprehensive Exam Prep for All 50-State Certification, by Phil Cirone and Richard Freeman

Claims Adjusters play a central role in the insurance industry, but it’s often a demanding and sometimes contentious job. When policyholders experience losses, they’re usually coping with some emotional turmoil. That can it challenging to work with them, especially when their claims aren’t approved. If you’re curious about related jobs that require similar skill sets, consider the below options!

- Construction and Building Inspector

- Cost Estimator

- Customer Service Representative

- Emergency Management Director

- Fire Inspector

- Fraud Investigator

- Insurance Agent or Broker

- Insurance Underwriter

- Legal Assistant or Paralegal

- Loss Control Specialist

- Property Appraiser

- Risk Manager

Newsfeed

Featured Jobs

Online Courses and Tools

Annual Salary Expectations

New workers start around $58K. Median pay is $75K per year. Highly experienced workers can earn around $91K.