Spotlights

Insurance Agent, Insurance Sales Agent, Sales Agent, Sales Associate, Sales Representative, Underwriting Sales Representative, Personal Financial Advisors

Life is filled with risks. We never know when something could happen that might disrupt our lives and our finances, too—if we don’t plan ahead.

From accidents to medical issues, natural disasters, property theft, and many other situations, the risks we face every day have the potential to cost us a lot of money, unless we’re protected with insurance coverage.

When we need help finding the right insurance, we can turn to Insurance Brokers. Unlike insurance agents, Insurance Brokers can be more objective because they don’t work for any specific insurance company. As PeopleKeep explains, “They’re under no contract, so they can solicit price quotes from multiple insurers.”

Thus, Insurance Brokers can fully represent their client’s best interests, comparing and explaining plans from multiple companies to get the best deal.

- Helping clients find the right insurance coverage for their needs, at a price in their budget

- Educating clients about complex insurance options so they understand what they are buying

- Building lasting relationships and helping families when they have claims

Working Schedule

- Insurance Brokers usually work full-time in traditional office settings, though travel may be necessary to meet clients.

Typical Duties

- Meet and consult with clients to understand their specific insurance needs and financial objectives

- Offer suggestions that clients may not have considered

- Analyze a range of insurance policies to find the best options for clients

- Provide expert advice on various insurance products, including life, health, and property insurance

- Explain the details of the various policies, including ways to customize them

- Negotiate with insurance providers on behalf of clients

- Get client policies approved through the insurance underwriting process

- Note, that underwriting is the process of evaluating the risk of insuring a person or asset, determining coverage terms, and setting premiums

- Obtain a binder (a written or verbal commitment of insurance coverage) from the insurance company or an authorized agent; or turn over the client’s account to the insurance company

- Assist clients when they need to file a claim

- Develop and maintain professional relationships with insurance carriers

- Manage client portfolios and policy renewals

Additional Responsibilities

- Stay updated on insurance products, as well as industry changes and regulations

- Develop marketing strategies to attract new clients

- Ensure compliance with state and federal insurance regulations

- Offer personalized service to ensure client satisfaction

Soft Skills

- Ability to work independently

- Analytical

- Attention to detail

- Calm under pressure

- Cooperative

- Customer service

- Empathy

- Leadership

- Methodical

- Negotiation

- Networking

- Objective

- Problem-solving

- Relationship building

- Strong communication skills, including active listening

Technical Skills

- Calendar/scheduling programs

- Customer relationship management

- Financial analysis software

- General office programs (word processing, spreadsheets, presentation software)

- Insurance analysis software

- Insurance laws and regulations

- Insurance rating software

- Insurance underwriting processes and programs

- Risk assessment and financial planning

- Sales and marketing skills

- Videoconferencing

- Independent brokerage firms

- Insurance companies with brokerage divisions

- Self-employed independent consultants

Insurance Brokers must continuously update their knowledge of insurance products and ever-changing regulations. This requires dedicating hours to study and professional development to stay competitive and compliant, and that time isn’t usually compensated.

The job may also demand being on call to meet client needs, which is sometimes necessary to maintain a client base in today’s competitive markets. Insurance Brokers often face rejection and must navigate the stresses of fluctuating income due to the commission-based nature of their work.

Technology continues to be a major influence in this industry. Insurance Brokers are adapting by integrating digital tools like customer relationship management systems and online comparison tools for faster service. In addition, brokers are personalizing insurance offerings using data analytics. They’re also navigating new regulations with compliance software and focusing on growing niches like cyber insurance!

The impact of climate change has increased demand for policies covering natural disasters. Additionally, the rise of telehealth services is being incorporated into health insurance policies, reflecting a positive shift towards digital healthcare solutions.

Individuals drawn to this career field often exhibited a knack for problem-solving and analytical thinking from a young age, enjoying activities like puzzles and strategy games. They may have liked helping and advising others and could have had early involvement in debate clubs or sales activities—which honed their communication and persuasion skills!

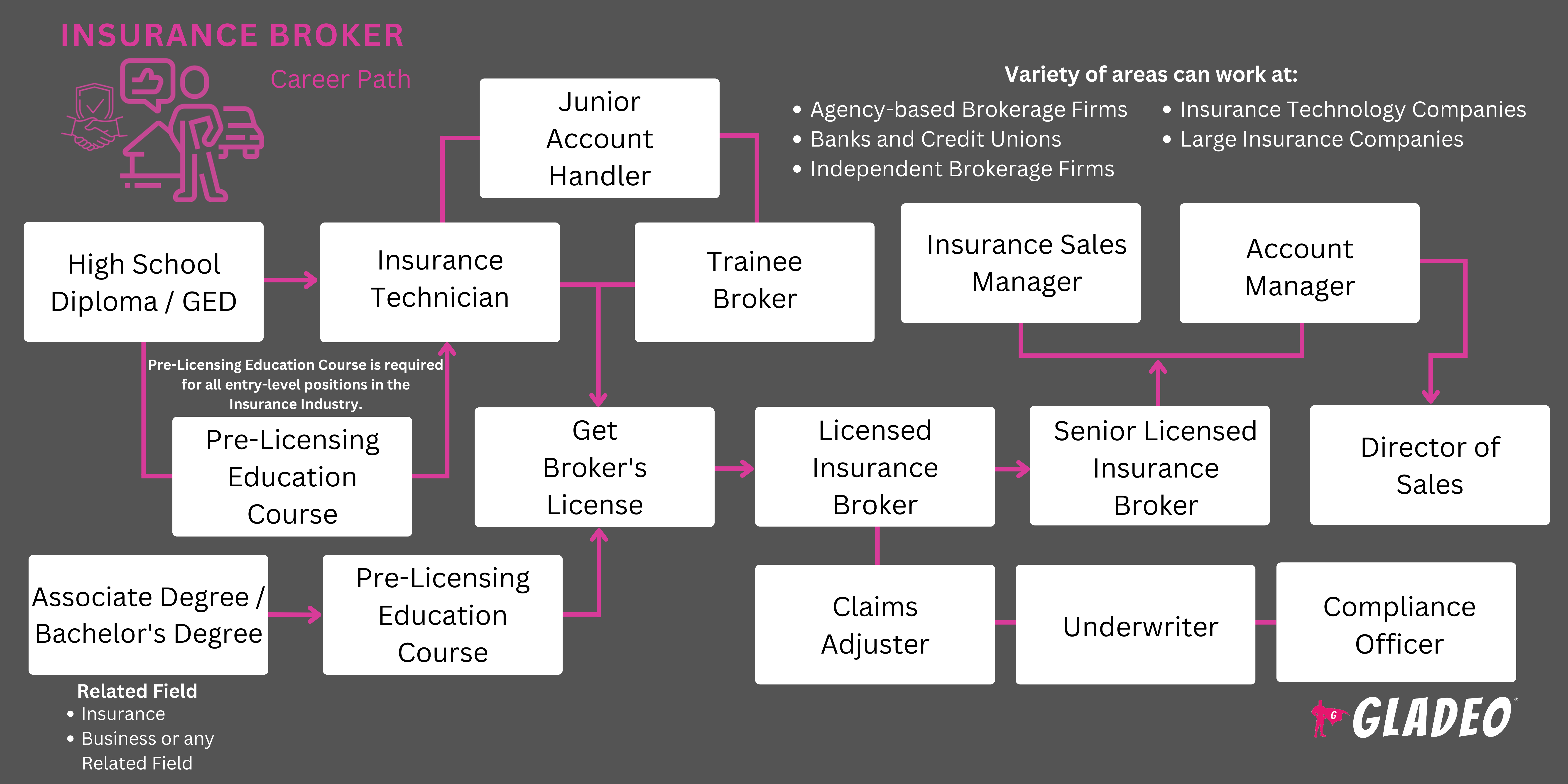

- A college degree isn’t always required, but many employers look for candidates with a degree in finance, business, or a related field

- Some students simply enroll in an insurance licensing program via an online program, local community college, or university

- There’s also the option to apply for an internship at a local firm. Interns who do very well may have job opportunities awaiting them, though employers may still have them take specific pre-licensure courses

- Common college course topics include:

- Accounting

- Business Law

- Communications

- Economics

- Ethics in Insurance

- Finance and Financial Management

- Life and Health Insurance

- Principles of Insurance

- Property and Casualty Insurance

- Risk Management

- Sales and Marketing

- Statistics and Actuarial Science

- Many duties are learned on the job, along with learning details about specific products, processes, and policies

- State-specific licensing is necessary and usually involves enrolling in pre-licensing courses before taking and passing a state exam

- The National Insurance Producer Registry makes licensure applications and renewals easier, especially for those who sell in multiple states and need a non-resident license

- Licensure requirements also vary by the type of insurance being sold

- For example, a Property and Casualty License allows brokers to sell a wide range of insurance policies, such as auto, home, and business insurance

- A Life, Health, and Accident License lets brokers sell life and health insurance policies, including annuities and disability insurance

- Those selling financial products must be licensed by the Financial Industry Regulatory Authority

- To qualify for a license, Insurance Brokers must be at least 18 years old. In addition, they typically need to pass a background check, not owe any past due child support or taxes, and not have any fraud or felony charges

- Continuing education is a must to keep up with changing programs and laws, and is necessary to renew licensure

- Courses needed for licensure renewal may be related to various insurance laws, consumer rights, or ethics, among other topics

- Optional certifications include:

- American Society of Pension Professionals and Actuaries - Certified Pension Consultant

- Corporation for Long-Term Care Certification - Certification in Long-Term Care

- Global Association of Risk Professionals - Certified Financial Risk Manager

- LOMA - Fellow, Life Management Institute

- National Association of Plan Advisors - Qualified Plan Financial Consultant

- The Institutes - Associate in Personal Insurance, Associate in Insurance Services, Associate in Fidelity and Surety Bonding, and more

- The National Alliance for Insurance Education and Research - Certified Insurance Counselor, Certified Insurance Service Representative, or Certified Risk Manager

- A college degree isn’t required for this field, but finance and business degrees are popular options for those seeking bachelor’s degrees

- Consider the cost of tuition, discounts, and local scholarship opportunities (in addition to federal aid)

- Think about your schedule and flexibility when deciding whether to enroll in an on-campus, online, or hybrid program

- Note, that some training programs may have connections with local employers!

- Good high school courses to focus on include math, accounting, speech, debate, English composition, business, marketing, and business communications

- Search the web for suitable training programs that fit your needs. Many community colleges and universities feature relevant programs, but you can also find reputable online options to study from home at your own pace

- It’s easy to gain sales and customer service skills via any number of customer-facing part-time jobs

- Ask local Insurance Brokers or agents about volunteering, shadowing them, or internship opportunities

- Decide if there is a particular type of insurance you want to specialize in, such as:

- Accident insurance

- Auto insurance

- Business loss of income

- Casualty insurance

- Commercial inventory insurance

- Disability insurance

- Health insurance

- Homeowner/commercial insurance

- Life insurance

- Travel Insurance

- Start a draft resume early to keep track of the education and experience you acquire

- Knock out the applicable training you’ll need to qualify for the job you want

- Talk to your program advisor. Some schools have connections with companies looking to hire new talent

- Gain experience through internships or entry-level positions in the insurance or financial services industries

- Obtain the necessary licensing for your state

- Scan traditional employment portals like Indeed and Glassdoor, but also look on sites such as Craigslist for smaller local opportunities

- Consider earning a certification to stand out to employers

- Reach out to everyone you know who might have a lead on a job, including teachers and classmates

- Contact local insurance brokerages or companies to see if they’re hiring!

- If planning to launch your own business, obtain a business license in your state, as needed

- Check out Insurance Broker resume templates and sample interview questions (such as “What information do you collect from clients before searching for an insurance policy?”)

- Use dollar figures when possible, and pepper your resume with applicable keywords such as:

- Claims Handling

- Client Acquisition

- Customer Service Excellence

- Insurance Products Knowledge

- Market Analysis

- Policy Customization

- Regulatory Compliance

- Risk Assessment

- Sales Strategy

- Underwriting

- Be enthusiastic and confident during interviews, know the terminology, and, of course, dress for interview success!

- Remember that many employers looking to hire new brokers will place a lot of value on your “trainability.” In other words, they don’t expect you to know everything already, but they want to see that you’re eager and willing to learn

- Talk to your employer or supervisor about career advancement. If necessary, consider switching employers if it’s the only way to move up

- Think about launching your own brokerage or independent consultant business

- Customer service is crucial to success in this profession. That includes knowing what your clients value the most. Some clients are looking more for savings; others just want highly personalized policies

- Earn your clients’ trust and establish a solid professional reputation as early as you can to get repeat business

- If you don’t have a degree, consider earning one or strengthening your credentials by pursuing optional certifications such as:

- The Institutes - Associate in Personal Insurance, Associate in Insurance Services, Associate in Fidelity and Surety Bonding, and more

- The National Alliance for Insurance Education and Research - Certified Insurance Counselor, Certified Insurance Service Representative, or Certified Risk Manager

- Become proficient in all the applicable software programs and systems

- Stay up-to-date on changes impacting the industry

- Keep growing your network of colleagues at insurance agencies

- Mentor other Insurance Brokers and get involved with professional

organizations (see our list of website resources below), workshops, and other events

Websites

- America’s Health Insurance Plans

- American Council of Life Insurers

- American Property Casualty Insurance Association

- Financial Industry Regulatory Authority

- Group Underwriters Association of America

- Independent Insurance Agents and Brokers of America

- Insurance Information Institute

- International Association of Insurance Professionals

- Million Dollar Round Table

- National Association of Health Underwriters

- National Association of Professional Insurance Agents

- National Insurance Producer Registry

- The American College of Financial Services

- The Institutes

Books

- How To Be A Super Insurance Broker: A Complete Commercial Insurance Training Guide, by Satvinder Breeze

- Property and Casualty Insurance Concepts Simplified: The Ultimate How to Insurance Guide for Agents, Brokers, Underwriters, and Adjusters, by Christopher J. Boggs, George Jack, et al.

- The Commercial Insurance Broker Playbook: If It Was Easy, Anybody Could Do It, by Stephen P. Heinen

Insurance Brokers can make a good living, but it takes a lot of hustle to find leads plus a strong commitment to continuous learning. In addition, many consumers these days forego dealing with brokers and turn to online policy comparison tools and agencies. If you’re curious about some related occupations, consider the list below!

- Advertising Sales Agent

- Credit Authorizer

- Credit Counselor

- Customer Service Representative

- Financial and Investment Analyst

- Insurance Claims and Policy Processing Clerk

- Insurance Underwriters

- Loan Officer

- Personal Financial Advisor

- Real Estate Broker and Sales Agent

- Sales Manager

- Securities, Commodities, and Financial Services Sales Agent

- Wholesale and Manufacturing Sales Representative

Newsfeed

Featured Jobs

Online Courses and Tools

Annual Salary Expectations

New workers start around $38K. Median pay is $46K per year. Highly experienced workers can earn around $57K.