Spotlights

Private Equity Analyst, Private Equity Associate, Private Equity Investment Professional, Private Equity Principal, Private Equity Partner, Private Equity Fund Manager, Private Equity Vice President, Private Equity Director, Private Equity Managing Director, Private Equity Investment Manager

Private Equity positions are highly sought-after careers. Private equity firms manage investment capital to own controlling interest in a number of companies. They will earn money through whole or partial ownership of the companies, as well as earning a fee for managing the companies. They do this through both financing the company and obtaining profits from the company. They also typically sell the company after several years for more than their purchase price.

- Supporting different types of companies

- Excellent compensation if successful

- First-year associate: $50,000 to $250,000, with an average of $125,000. An average first-year salary may be $81,000, with a bonus of 25-50 percent of base salary.

- Second-year associate: $100,000 to $300,000, with an average of $135,000.

- Third-year associate: $150,000 to $350,000, with an average of $160,000.

Duties as a private equity associate can include the following:

- Analytical modeling: The primary function of the associate is to provide all analytics required for the principals and partners to make an informed decision about a deal. Common tasks include preparing preliminary due diligence reports and modeling with growth forecasts.

- Portfolio company monitoring: Associates are usually assigned portfolio companies to monitor and must maintain up-to-date financials.

- Reviewing CIMs: CIMs or confidential information memorandum are documents investment banks use to provide data about new investment opportunities. Associates receive the CIMs, screen them for potential opportunities that fit within the firm's framework, and provide a simple one-page summary for the senior team.

- Fundraising: When new funds are being formed, associates assist with preliminary fundraising while senior executives handle most of the relationship and client interface.

Soft Skills

- Stamina

- Social Skills – Oral/Written Communication

- Creativity

- Analytical Skills

Technical Skills

- Office software for word processing, spreadsheets, databases, and email.

- Data Analysis software understanding.

- Research ability for industry shifts and acquisitions.

- Advanced business knowledge and how to attract investors.

Many firms have 2-3 year training programs for new employees. As an entry-level associate, much of the “grunt” work will fall on your shoulders so you can expect 12 or more hour days during these first few years.

You will be expected to already be well-versed in finance, so firms will take a hard look at your grades and even your school before offering to hire you.

Private Equity firms are growing in value, if not in employees. There is a greater need to acquire and use data analysis in finding excellent deals to invest in. Recently, invested companies have been reaching price targets faster – a sign of a coming recession. This can result in a greater need for private over public equity (like the stock market).

Much of the private equity growth has been in Europe, but growing concerns for a recession have slowed this somewhat. There is also a greater emphasis on a company’s social and environmental impact.

- Raised money such as lemonade stands.

- Participated in concessions sales at sporting events.

- High achiever and competitive

- Extremely attentive to detail

- Interested in investing

- Interest in long term projects

- Private Equity Analysts and Associates generally have at least a bachelor’s degree in finance, economics, accounting, or statistics. Math is also an option

- Students must learn how to use databases, analytical, and modeling software (such as Excel and Visual Basic)

- Common courses include contract law, banking, corporate restructuring, international business, and foreign languages, writing, leadership, debate, and speech

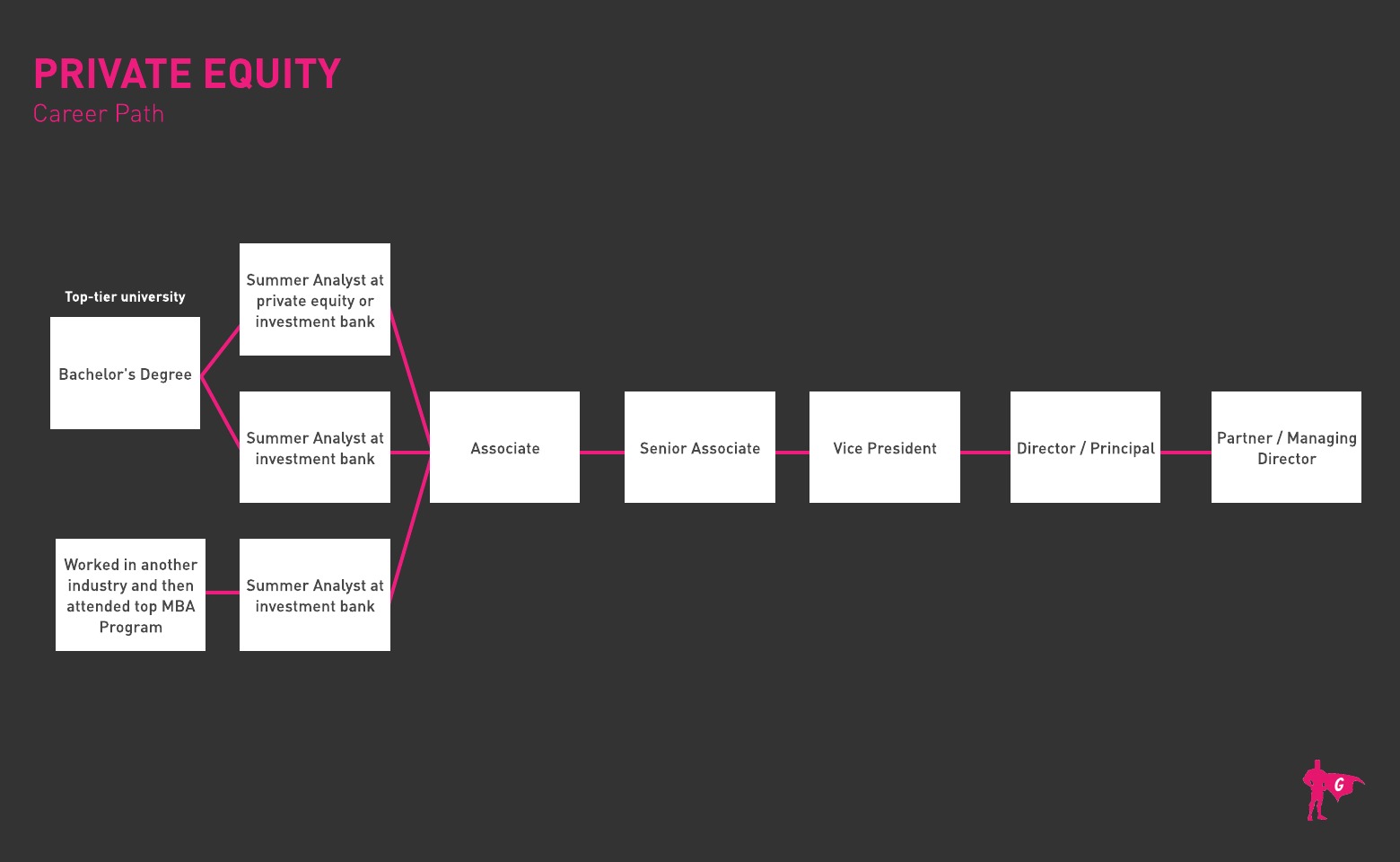

- Private equity firms do not usually hire straight out of college or business school unless the student has previous significant private equity internships or work experience.

- The most important qualification to become a private equity analyst is two to three years prior experience as an investment banking analyst. Some firms also hire former management consultants.

- An MBA isn’t required but will help you stand out to PE firms, especially if you also have work experience

- Look for opportunities to get in front of groups and make persuasive speeches and presentations

- Sign up for debate classes or clubs; study how to negotiate to reach amiable agreements

- Consider which path you want to take to break into Private Equity. Most students don’t land jobs with PE firms right after finishing their bachelor’s. Many start by working as investment banking analysts or with consulting firms

- Study investment strategies and markets by reading books and articles and by watching the news

- Keep your LinkedIn profile up-to-date and write posts to show off your equity insights

- Submit articles to Medium or online financial publications to boost your credentials

- Join private equity and venture capital associations to make connections and gain exposure

The most common way to get into private equity is to get a summer analyst position at a private equity firm or investment bank during your undergraduate years. Both of these firms recruit from top tier universities. You will need to get have solid grades (GPA 3.5 and over).

If you perform well at your summer analyst position, you will get an offer to join as an analyst after you graduate from college.

Many investment banking analysts move laterally to a private equity firm as well.

- Use finance-related job portals like eFinancialCareers, Financial Job Bank, and the Association for Financial Professionals’ job board, in addition to Indeed, Simply Hired, and Glassdoor

- Spread the word to your professional network via LinkedIn. Reputation is critical in this line of work and many job opportunities aren’t posted

- Check out Private Equity resume examples to help craft your killer resume!

- Hire a professional resume writer to ensure your resume is ready to withstand the competition

- Study common interview questions and consider taking WSO’s Private Equity Interview Prep Course

This article does a great job explaining the different positions at a private equity firm: https://www.mergersandinquisitions.com/private-equity-career-path/

Websites

- American Investment Council

- New York Private Equity Network

- National Venture Capital Association

- Global Private Capital Association

- Women’s Association of Venture and Equity

- National Association of Investment Companies

Books

- Mastering Private Equity Set, by Michael Prahl, Claudia Zeisberger , et al.

- Private Equity Demystified: An Explanatory Guide, by John Gilligan and Mike Wright

- Private Equity: A Casebook, by Paul Gompers, Victoria Ivashina, et al.

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private Investing, by Robert Finkel, David Greising, et al.

- Venture Capitalist

- Investment Banker

- Stockbroker

- Financial Analyst

Private Equity is a difficult field to enter. There are few positions, even with growth, and you will be expected to work long hours. Most individuals enter the field after already having worked long hours in other financial areas. However, the firms are typically small in size and have a strong communal team feeling.

If you are set on a career in finance, Private Equity firms are one of the hardest firms to find employment with, as well as being a challenging job. However, if you are able to prove yourself as a profit creator and enjoyable co-worker you have a great chance at moving up the ladder.

Newsfeed

Featured Jobs

Online Courses and Tools

Annual Salary Expectations

New workers start around $76K. Median pay is $99K per year. Highly experienced workers can earn around $129K.